The outlook for the commercial real estate industry in 2024 remains nuanced, with some sectors facing more significant headwinds while others showcase resilience. By understanding the evolving dynamics of commercial real estate market trends, industry professionals can better position themselves to capitalize on the opportunities that arise and overcome the obstacles that lie ahead.

Key Takeaways

- The commercial real estate industry faces a mix of challenges and opportunities in 2024.

- Trends across different asset classes, such as office spaces, industrial properties, and multifamily buildings, will vary.

- Rising interest rates and high inflation are among the industry’s major challenges.

- Cash optimization, increasing housing supply, the impact of technology, and energy-saving measures present opportunities.

- Smart buildings can help optimize building performance and sustainability.

Commercial Real Estate Trends Across Asset Classes

While the commercial real estate outlook for 2024 remains largely unchanged from six months ago, the performance across different asset classes varies significantly. The national office building vacancy rate reached 19.2% in Q3 2023, approaching the historic peak of 19.3%. However, some experts believe that the office is not obsolete, and there may be opportunities to convert older, less desirable office spaces into alternative uses like apartments or data centers.

Industrial Properties

In contrast, the industrial properties sector has continued to demonstrate resilience, with strong demand driven by the growth of e-commerce and the need for modern logistics facilities. Developers have responded to this demand by ramping up construction, leading to a robust pipeline of new industrial properties coming online in the coming year.

Multifamily Properties

The multifamily properties segment has also remained a bright spot in the commercial real estate landscape, as the demand for rental housing remains high, particularly in urban and suburban markets. Investors have continued to target multifamily properties as a stable and income-generating asset class, despite the broader economic uncertainties.

| Asset Class | Performance Outlook | Key Trends |

|---|---|---|

| Office Buildings | Challenging, with high vacancy rates | Opportunities to convert older spaces into alternative uses |

| Industrial Properties | Resilient, with strong demand and new development | Driven by e-commerce growth and modern logistics needs |

| Multifamily Properties | Stable, with high demand for rental housing | Attractive as a reliable income-generating asset class |

Commercial Real Estate Challenges

While the commercial real estate industry continues to navigate a complex landscape, two key challenges have emerged as significant concerns: rising interest rates and high inflation.

Interest Rates’ Rising

According to 2023 Preliminary Trend Announcement, the bond market experienced significant turbulence during the first half of Q4 in 2023, with the five-year Treasury yield fluctuating by more than 0.50% as investors constantly adjusted their expectations about the Federal Reserve’s future monetary policy decisions. Although the likelihood of further rate hikes by the Fed has diminished more recently, the future of fixed-rate financing remains influenced by factors beyond the central bank’s control.

High Inflation

Alongside interest rate volatility, high inflation has also emerged as a major challenge for the commercial real estate sector. As costs continue to rise, property owners and investors must carefully manage their portfolios to maintain profitability and identify viable investment opportunities amidst the inflationary environment.

These commercial real estate challenges underscore the need for industry professionals to stay vigilant, adapt their strategies, and leverage innovative solutions to navigate the evolving market conditions effectively.

Commercial Real Estate Opportunities

Despite the challenges facing the commercial real estate industry, there are several promising opportunities that businesses can capitalize on in 2024. According to industry experts, the ability to optimize cash flow and move quickly to acquire stressed assets is paramount, particularly as interest rates fluctuate.

Cash Optimization

In a volatile market, cash optimization is essential for commercial real estate businesses to seize emerging opportunities. By investing in treasury services and innovative rent payment solutions, companies can better position themselves to act swiftly when favorable market conditions arise, such as when interest rates drop.

Increase Housing Supply

The ongoing housing shortage in many urban centers creates a significant commercial real estate opportunity to develop new affordable housing projects. By repurposing underutilized commercial spaces or partnering with local governments, real estate firms can help increase the supply of much-needed housing while also generating steady rental income.

Impact of Technology

The rapid advancement of proptech is transforming the commercial real estate landscape, offering a range of opportunities for businesses to enhance efficiency, reduce costs, and improve the tenant experience. From smart building automation to predictive maintenance, commercial real estate opportunities abound for those who embrace technological innovations.

Energy-Saving Measures

As the demand for sustainable, energy-efficient buildings grows, commercial real estate developers and owners have the chance to capitalize on energy efficiency initiatives. By investing in green retrofits, renewable energy sources, and other energy-saving measures, they can attract environmentally-conscious tenants, reduce operating costs, and contribute to the industry’s broader commercial real estate opportunities.

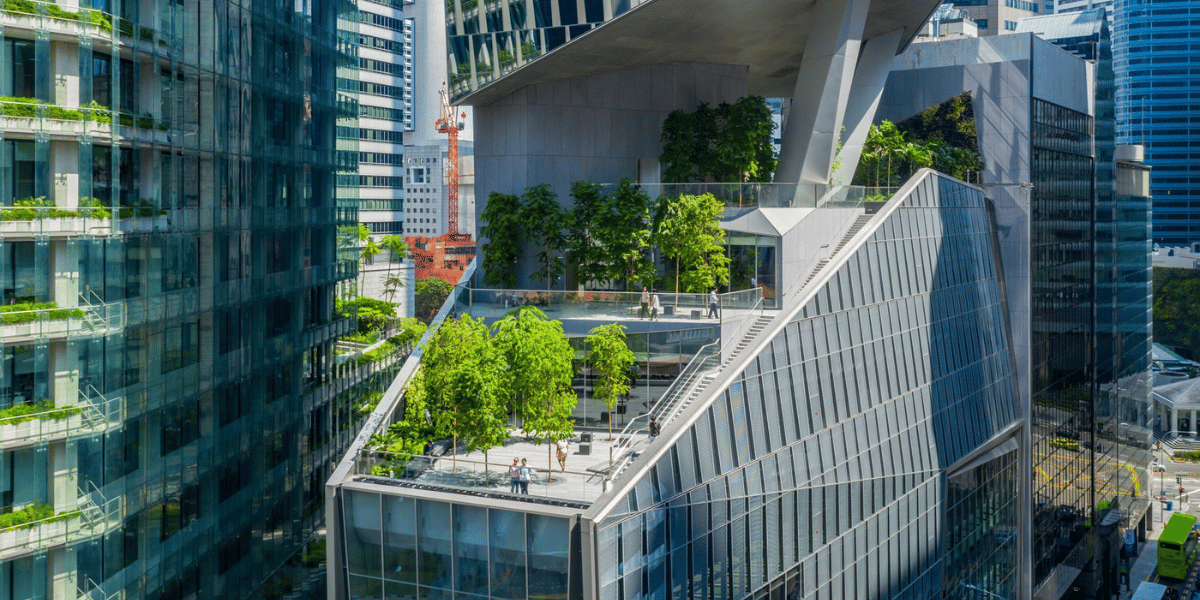

Smart Buildings: Optimizing Performance

As Proptech continues to revolutionize the commercial real estate industry, the concept of smart buildings has gained significant momentum. Smart buildings leverage advanced technologies to monitor, control, and optimize their systems, providing benefits to owners, operators, and occupants alike.

Accelerate Decarbonization

One of the primary advantages of smart buildings is their ability to drive energy efficiency and sustainability. Integrated sensors, smart controls, and data analytics enable smart buildings to optimize their energy consumption, reducing carbon emissions and operating costs. By harnessing the power of smart buildings, commercial real estate can accelerate its decarbonization efforts and contribute to a more sustainable future.

Improve Occupant Comfort

Smart buildings also prioritize the comfort and well-being of their occupants. Intelligent HVAC systems, lighting controls, and air quality monitoring ensure that indoor environments are tailored to individual preferences, enhancing occupant comfort and productivity. This focus on occupant comfort not only benefits tenants but also helps building owners attract and retain high-quality tenants.

Enhance Security

In addition to energy efficiency and occupant comfort, smart buildings offer advanced security features. Integrated access control systems, video surveillance, and intruder detection technologies help protect the building and its occupants, providing a heightened sense of safety and security. This comprehensive security approach is crucial in today’s commercial real estate landscape.

System Connectivity

The hallmark of a smart building is its ability to seamlessly integrate and connect various building systems. From HVAC and lighting to access control and fire safety, smart buildings leverage system connectivity to optimize performance, streamline operations, and provide real-time insights to building managers. This holistic approach to system connectivity enables commercial real estate professionals to make informed decisions and enhance the overall efficiency of their properties.

Navigating the 2024 Real Estate Landscape

As the commercial real estate landscape continues to evolve in 2024, industry professionals must remain vigilant and proactive to capitalize on emerging property investment and property management opportunities. While the overall outlook may be muted, savvy investors who maintain a keen eye and ample liquidity will be well-positioned to seize upon potential asset acquisitions when favorable conditions arise.

With many asset classes experiencing a period of moderation, the ability to swiftly act on compelling deals will be a critical differentiator. Professionals who have thoughtfully managed their cash reserves and financing options will be better equipped to navigate the nuances of the 2024 commercial real estate market and uncover value-driven property investment prospects.

Conclusion

As the commercial real estate industry navigates the challenges and opportunities of 2024, the outlook remains a mix of cautious optimism. While sectors like office and retail continue to grapple with ongoing obstacles, other asset classes, such as industrial and multifamily properties, are demonstrating more resilience.

As the industry evolves, the ability to adapt and seize new possibilities will be the key to navigating the commercial real estate landscape in 2024 and beyond. By staying informed, innovative, and agile, industry players can overcome the obstacles and capitalize on the exciting industry outlook and challenges and opportunities that the future holds.